A business exit strategy may not be the first thing you think about when you start your business. And why should you? The dream of anyone going into business is to create a service that is functional for many people. By doing so, they create an impact and leave a legacy, while making a handsome profit.

After labouring for considerable time building the business to success, business owners often find themselves faced with the decision of leaving. Once they’ve considered exiting their business, the reasons for the exit are widely varying. Taking a retirement or focusing on other ventures are common reasons. You may even be searching for an exit when your venture is not going well. Regardless of your motives, it is always a plus for you to be ready for the time to sell.

That is what this article is going to do for you. We present to you the ultimate guide to designing an exit strategy for your business. Uscita is your partner in providing a comprehensive solution in exiting your engineering, manufacturing and B2B services businesses.

As is our practice at Uscita, we are here to help you make the best decisions when parting from your company. So let’s get into it.

Looking for a handy checklist that will walk you through the salient points? We have one for you to download here.

What is a business exit strategy?

What is an exit strategy? It’s a road map for when and how you want to leave the company.

It’s simply a step-by-step plan for a business owner to pull out from the business. Because your intentions may be widely varying, a business exit strategy may take different forms. How to prepare to sell your business usually involves reducing or liquidating your stake in the business to make a profit.

An exit strategy may indicate the end of your involvement in the business or the end of the business entirely. While this may be true, a business exit strategy is often incorporated as you make the initial business plan before commencing operations. The choice of an exit strategy usually affects the path through which you grow the business.

The decision to implement the business exit strategy often falls on one of these reasons:

- To reduce your stake and your control of the business freeing you up to pursue other activities

- To make a substantial profit if the company is profitable

- To cash out of an investment (common with venture capitalists)

- To limit or put a stop to the losses if the business is unsuccessful

Regardless of the reasons, the exit plan is implemented in the same way and requires sufficient planning for success.

Why do you need an exit strategy?

A business exit strategy helps an entrepreneur to make decisions about the future of the business. It lays out a plan for when to sell shares, manage assets, and how to position themselves in the marketplace.

Exit strategies are not just about selling – they can be about divesting parts of your business or even buying another business. They also help to give you with a clear direction when you’re still in the growth stage. With the right plan, you’ll be able to determine the right tactics you should pursue that will bring you closer to your goals.

In fact, business owners may develop exit strategies for a wide range of reasons, not just a high revenue.

In the event of a personal health issue or a family crisis, you may need to step down as the CEO. You would want to plan for this from the beginning so that your company will always be in good hands.

Secondly, there are many entrepreneurs out there looking for ways to avoid the effects of an economic recession.

Large players may be interested in acquiring your company. It might not be something you’re immediately ready for, but it’s always insightful to have some sort of exit strategy just in case.

Finally, having a clear goal will help you steer your company in the right direction. You’ll know where you’re going and what steps to take along the way with a clearly defined exit plan.

Not having an exit strategy when an unexpected situation arises puts the business at risk of failure, bankruptcy, or even foreclosure.

Types of exit strategy

Understanding business exit strategy as simply selling a business might sound obvious. It’s often not as straightforward as putting a for-sale sign up outside of your business premises though.

If you dream of a business-free future filled with lavish holidays and providing security for your family, many options are available. They depend on whether you want a clean break or to stay involved (either on a day-to-day basis or in an advisory capacity). You should also reflect on if it’s essential to secure employee stability, leave a legacy for yourself within the business community, or preserve your company’s name. You’ll also need to consider if you want an ongoing income after your departure.

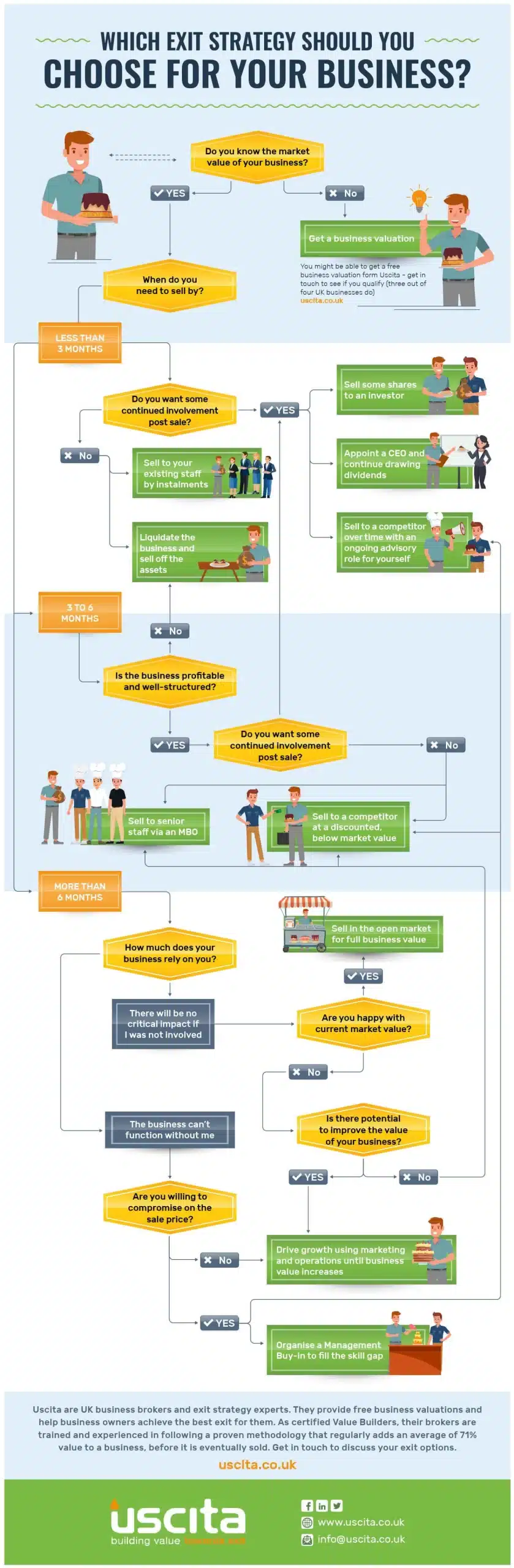

These are not easy questions to answer off-the-cuff, so we’ve put together a paired back flowchart to walk you through the available choices and to help you on your way. Start by answering yes-or-no questions below to get an initial idea of the best exit strategy for you.

Share this image on your site

<a href=’https://uscita.co.uk/infographic-business-exit-strategy-future-of-your-dreams/’><img src=’https://uscita.co.uk/wp-content/uploads/2019/11/business-exit-strategy-choices-infographic.jpg’ alt=’Business Exit Strategy Choices Infographic – Uscita’ width=’1602′ border=’0′ /></a><br /><br /><strong>Infographic by Uscita</strong>

As you can see, there are lots of business exit strategy options on the table. All begin with understanding how much your business is worth and the time you want to allow for your exit. Usually, more time increases the number and quality of available options. However, even if you’re short on time, all is not lost. Below is a summary of all the different options you may want to consider.

Sell to your existing staff by instalments

This is a good option if you don’t need to receive payment right now, but you do need to leave the business quickly. It also ensures your employees carry on working at your business and that the culture you’ve created has the best chance of enduring. Your staff will need to be stable, committed to the business and skilled enough to take on your ownership roles – unless you want to maintain a mentoring role after you leave.

Liquidate the business and sell off the assets

This is the fastest option to completely wrap up your company. It can be completed within as little as three months if required. If ultra-fast liquidation is required, you may not achieve market value though there are lots of companies that can help you achieve that.

Sell some shares to an investor

Consider this business exit strategy if you want to maintain a degree of day-to-day involvement in the company and an influence on its future. Selling shares can be completed within three months – having established connections and similar experience helps.

You’ll get less money in the short-term – but if the company performs well, you will continue to get dividends. You may ultimately be able to sell at a much higher price if the company continues to thrive.

Appoint a CEO and continue drawing dividends

Appointing a CEO will let you step back entirely from day-to-day operations but still draw down dividends. Some owners use this opportunity to take on the role of Chairman. It can take less than three months to make a CEO appointment. However, if there is time, some business owners find external mentoring and coaching much earlier on in the process is useful for both parties.

Sell to a competitor over time with an ongoing advisory role for yourself

Selling your business to a competitor over time allows the company to benefit from your expertise. This may help command a premium price – even beyond the original market value. You can take a hands-on or advisory position, as preferred. Eventually, you will decrease your responsibilities as the new owners gain more confidence in their new company.

Sell to senior staff via an MBO

You can complete an MBO in three to six months when required but often it will take much longer because the process needs to account for a period of succession planning and mentoring. Employees, company culture, and independence are all likely – although not guaranteed – to stay intact.

Sell to a competitor at a discounted, below market value

If you’re looking for a quick sale, a competitor may be very happy to snap up your staff, expertise, contacts, contracts, and other resources at a discounted rate. It can take as little as three months to do this.

Remember, however, that you’ll be selling below market price. That is the pay-off for speed. As such, you should give this option serious thought and, if you can hold out a little longer for the full amount, then you certainly should do so.

Sell in the open market for full business value

If you are happy with the market value of your company, then this could be the most comfortable option. You’ll need to be prepared to wait upwards of six months and, if you want any further involvement, make sure that it’s clearly agreed in the terms of the sale.

Drive growth using marketing and operations until business value increases

Consider this option if you are not happy with the current market value of your business but can see the potential to grow it further. You will need to commit upwards of six months – and often a few years. You will also have to be prepared to invest the passion, motivation, and drive necessary to help your management and staff – and ultimately, your company – to fulfil its potential.

Organise a Management Buy-in to fill the skill gap

Bringing in an external manager or team of managers might be the way forward in some situations. For example, if you want the company to carry on trading once you’ve left, but the current staff lack the collective expertise to take on your role. This is usually a longer-term project with the business owner needing to remain hands-on during the transition phase.

What is a good exit strategy for business?

If you’re still confused about all the options, I don’t blame you! It’s a lot to take in.

To establish the best one for you, you need to be clear on what your goals are (e.g. how much you want to sell your business for) and what your timelines are. With that in mind you’ll get clarity on whether to pursue a profit-first approach or put more emphasis on the future of the business itself as your legacy.

Be mindful of the fact that even the strategies listed earlier may not be easy to achieve all of the time. Expertise and existing contacts help ensure a quick and hassle-free transfer. Entrusting the services of a business broker will help make the process smooth and on many occasions promote getting a better value deal.

A good exit strategy ensures the deal would more likely succeed and push through.

Exit strategy examples

We’ve helped to sell dozens of businesses over the decades we’ve been operating – and we have written about some of our work in this blog.

The best way to explore how other businesses have prepared for an exit is by looking at some of these case studies:

- Is this the perfect business sale?

- It could take years to sell your business

- Are you selling a business or just a client list?

How to plan an exit strategy for a business?

Without a doubt, you will get the best effects when you start planning your exit strategy as early as possible. Although the ideal method is to develop it as you start up the venture, it is not too late to make a plan now if you haven’t done so.

An exit plan is to serve as a guide, and in doing so, it should be comprehensive. In developing it, you should consider all variables and details and examine how much impact they will make when you want to implement the plan.

Following the guide below will help you craft a detailed and effective exit strategy.

Define what a successful business exit is to you

It is usual to find that the measure of success of most new business owners is profits. After all, a good business, through profitability, is supposed to eventually raise your standards and help you live a better life.

However, as you go on, the definition of success usually evolves. Business owners look to a long-term impact or legacy, much more than the bottom line.

For an entrepreneur hoping to get out of their business, the prospects of a substantial profit form the first stage of success. Usually, the idea is that once the venture is profitable enough, it is sold off, possibly to use the proceeds to launch another venture.

The second stage of success focuses more on the long-term. People with this view are often older and are already considering early retirement. In thinking of an exit strategy, the goal is to make enough to live comfortably during retirement and take care of kids or engage in other interests.

Any action taken is such that will make these intentions easiest to fulfil. Whether it is to sit tight and build the business further or sell it right away, you will be able to decide the best way for you.

The third stage of business success is one where you focus less on yourself and more on what you can do for others. Usually, at this stage, the business is big and profitable, and you don’t worry about money because it’s available. At this stage, you are considering leaving a lasting legacy.

This is a description of the spectrum of business success, and as your priorities change, you must tailor your business exit strategy to meet them.

Adjust how your business operates to match your exit goals

How your business operates significantly determines the steps you will take to exit from it. Trying to get your business sold doesn’t have to be tough. If potential buyers see the company’s value, they will come rushing to take it off your hands.

Part of planning to exit your business is arranging the operations in such a way as to make it attractive for prospective buyers.

One of the key things you can do to make your business appealing to buyers is to make it independent of you. Many business owners, either deliberately or otherwise, often find that the business revolves around them. If they were to step away for a minute, business operations would halt. As much as that may not be the most efficient way to run a business, it also doesn’t help your exit attempts.

For a business to be attractive to a buyer, it must be able to function outside the actions of particular individuals. So in planning your exit, you should ensure that the business is not too dependent on anyone.

In the early years of a business, it is common to find businesses reliant on their owners. But this is something to work on subsequently. Train your staff to be more capable to handle tasks while you’re away. In addition, let your clients get used to dealing with other people. With this, you will find it easier to take holidays as you’ve built an independent business.

Keep accurate records and document your processes

Having correct financial records implies that you have nothing to hide. Anyone planning to take over your business will be more confident when they can view the details of financial transactions and gauge the strength of the enterprise.

Furthermore, the independence of your business is helped when you share the knowledge you have with your team. You will do this most effectively by documenting the processes and procedures. These guides come in handy when you are present, as the work will continue smoothly.

With your exit in mind, you can begin documenting one process at a time until you have completed the spectrum. The same action applies to keeping accurate records of financial transactions. Because this might take a while to accomplish, it is preferable to start early.

Manage the relationships with your customers and suppliers

Your customers may have gotten used to dealing with you and would not like to transact with someone else. This is good. It shows how much effort you have put into cultivating excellent customer relations.

But when you are planning your exit strategy, you must carefully manage the customers. If they feel like you abandoned them, the business may lose their patronage. So you should take time to introduce them to other team members. This helps to build trust in the new person they will interact with when you are gone.

As for suppliers, it is essential not to be spread too thin. It is always a plus to have an array of suppliers. So while you may have a few preferred ones, you will not be taken for granted as they are aware you have many options. This also makes the business seem more robust and flexible by potential buyers.

Make sure contracts are up-to-date

In planning your business exit strategy, you should review the agreements binding on the business to ensure all is in order. Some contracts may be a snag in finalising your business sale, amongst other things.

Examples of such contracts to check out include staff contracts to ensure that all requirements have been taken care of. Examine your lease agreement and make sure they comply with regulations.

You should also review customer contracts. You should make sure that the business’s obligations, as well as the customer’s, are not violated as ownership is transferred.

Know your value

It is expected that as time moves on, the value of your business changes. It is crucial to keep track of the value of the business over time through shifting market trends or regulations.

A sense of the value of the business also helps the exit plan. With it, you can get an accurate worth of your company when a new owner buys you out.

Components of an exit strategy

There are three phases of an exit strategy: Preparation, Execution, and Post-Exit activities.

These stages take place once you’ve started working on the steps in the previous section.

The preparation phase includes identifying the right time and method for exiting the business, preparing for the sale or transfer by hiring a broker or estate planner, and preparing financial statements.

The execution phase includes soliciting offers; getting professional advice; negotiating; dealing with tax issues; deciding on terms of sale; drawing up contracts; closing on the sale or transfer of the company assets; transferring ownership on trade secrets or patents; terminating employees.

The post-exit phase is an important and critical time when exiting a business. It is during this time that the owner must take care of final details such as complying with tax and legal requirements. They also need to do some personal reflection, think about what they will do next, and how they will spend their time.

What is the exit strategy in a business plan?

As stated earlier, the ultimate choice of an exit strategy depends on what you wish to achieve. When creating a business plan, you may not know the exact path you should take, but it’s good to include one of the options below as a guide.

Here is a list of exit pathways you can explore.

- Liquidation: In this, you close the business, sell off the assets and stock options and walk away. This usually spells the end of the company.

- Strategic sale: Here, you approach competitors with an offer to take the business off your hands. This is a plus for both parties when the competitor will benefit from owning your business.

- Management buyout (MBO): The senior management team, if interested, takes over the business in this method. The team buys your stake in the company, allowing you to take your exit.

- Employee owned business: This is just like an MBO, except that the employees, instead of senior management, assume ownership of the business. This is an excellent way to ensure staff retention if you are particular about that.

- Investment: You may get investors to buy a part of your stake in the business. This may mean having to continue to function in the business for a while longer.

This list is not exhaustive, and the eventual choice you make may not be known while planning your exit at the beginning of the business. Also, depending on how you build your business, your preferences may change over time. However, knowing about them helps you eliminate some choices and pick what works best for you.

Exit strategy for a small businesses

The best exit options for small businesses will be different from those for larger companies. The most popular strategies to consider are:

- Liquidation – where you close your business and sell off its assets or redistribute them to creditors and shareholders. You can do it all in one go if time is of the essence, or you can also do it over time focusing on maintaining your lifestyle over that period.

- Sell the business to a family member or an employee – you’ll usually create a seller financing agreement so that the buyer can pay off the business gradually (also referred to as Vendor Financing). This is a good option if you still want to be involved in the business for some time.

- Sell the business in the open market – you can find a broker specialising in small businesses or your particular niche or location – or you may list the business on a broking website yourself for a fee. Be prepared that the process may not be smooth and it can take longer for you to find the right buyer.

- Sell the business to another business – you can get acquired by a competitor or if another company wants to expand their offering. This can be a lucrative option for you and you’re likely to remain involved but some of your employees may be laid off during the process.

Exit strategy for a medium size business

If you have a medium size business that makes £1M – £10M in annual revenue, your options will still include all of the ones in the previous section. Below are some differences and new additions:

- Selling in the open market will likely look differently. For a medium size business, working with a broker is invaluable. They will ensure you have a fair valuation and they will use their existing contacts and expertise to find a buyer efficiently, profitably and keep things confidential. They will also suggest ways to improve your valuation or chances of selling.

- When choosing a broker, it’s good to find one that has helped similar businesses before. At Uscita, we specialise in manufacturing businesses as well as engineering and professional services businesses in Cheshire, so get in touch if you’d like to have an initial consultation and valuation.

- Enter an IPO (Initial Public Offering) and “go public”. This involves selling your shares to the public and it can be a lengthy and expensive process. The returns are usually good as well.

Exit strategy for a large business

A large business comes with even more complexities. Different stakeholder relationships and share structures will require more detailed preparation and due diligence.

With hundreds of employees at stake, you will likely want to make sure that any transition is smooth. Your financial records will be scrutinised thoroughly. Contracts will be evaluated for validity and continuity.

With these and more factors, you will likely need a team of experts to support your exit process, each specialising in their individual fields of expertise. Choose a broker firm that will be able to support your complex needs and that has expertise in your niche and with your business size.

What is the difference between harvest and exit strategy?

A harvest strategy is a marketing and business strategy where you reduce or cut back on investments so that entities involved can reap the maximum profits. It is typically employed at the end of a product’s life cycle, when it has become clear that any investments made will not increase profits.

An exit strategy, on the other hand, is a process of transferring stake in a business venture with the intention of removing yourself from it.

A key difference between exit and harvest strategies is that an exit strategy can be executed at any point of time during the life cycle of a business venture whereas harvesting requires a conducive environment in terms of both internal and external factors to be effective.

A harvest strategy is usually employed at the end of a successfully run business where existing products are at the end of their life cycles and there is no appetite to launch new products. In that sense it can be seen as one exit strategy that can be considered.

How long will it take to sell my business?

Selling a business is generally not something that gets done super fast. Often, the efforts start from making the business appealing by racking up the profits and balancing the books.

Advertising, waiting for potential buyers and engaging in negotiations are other activities to perform, which can take a considerably long time. A business sale may take months or even years to complete, so the time varies.

To hasten the sale of your business, you should try to make the company more sellable. Sellability is an estimate of the ease of selling a business, and it is influenced by a range of factors. Profitability, marketability, and the existing demand for it are some of the aspects that come into play.

Essentially, the more sellable the business is, the shorter the time you need to close the sale.

Conclusion

You have read a guide to a business exit strategy. Now, you can begin to make plans and advance real steps to exiting your company. Remember that the earlier you start the process, the more smoothly it’s likely to go.

Alternatively, you can contact business sale experts to help design your exit strategy. Uscita is a business broker with over a decade of experience and over a hundred business deals completed in the manufacturing, engineering and professional services sectors. Contact us today and start exploring your exit strategy.